Pre-commitment activity in India’s office market

In the midst of a pandemic, robust pre-commitment activity augurs well for the future of the office market in India.

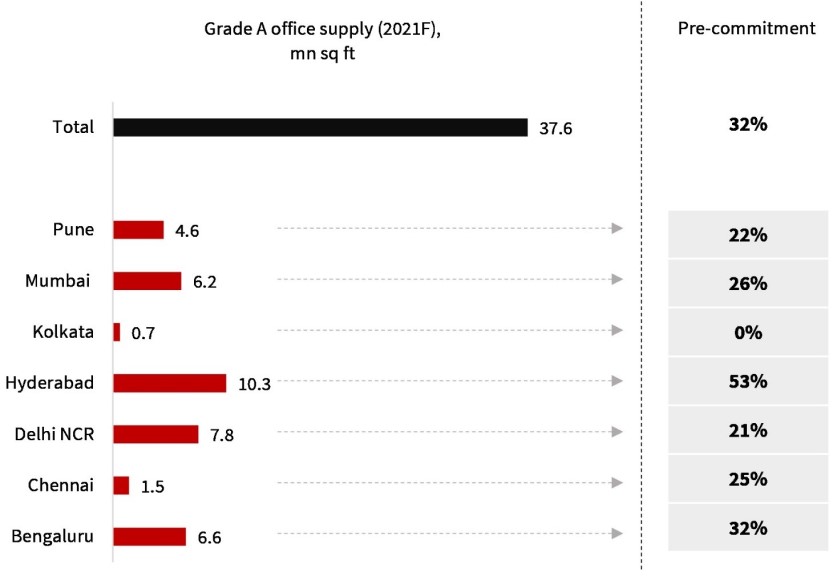

The Indian economy was already facing turbulence prior to the COVID-19 pandemic. The spread of the virus and subsequent containment measures further disrupted economic activity in the second quarter of 2020, putting brakes on India’s booming office market. However, the third quarter witnessed green shoots of recovery as net absorption increased by 63% q-o-q. Sentiments improved further in the last quarter of 2020 with the news of potential vaccine development, and the office market continuing its recovery momentum. In the second half of 2020, the recovery momentum was backed by strong pre-commitment activity, as more than 50% of the Grade A supply during H2 2020 was already pre-committed . The current year is expected to witness completions of 37.6 million square feet of Grade A office space, 32% of which has already been pre-committed (Figure 1). The healthy pre-commitment levels shall ensure that the recovery momentum continues in 2021, with net absorption expected to hover around the 30 million square feet mark.

Interestingly, Hyderabad’s pre-commitment activity in 2020 stood at an astonishing 80% of the Grade A office supply. The market continues to witness the highest pre-commitment levels, with more than half of the expected supply in 2021 already pre-committed. The other southern market of Bengaluru follows Hyderabad in pre-commitment activity.

Figure 1: Maximum pre-commitment in Hyderabad

Low vacancy submarkets account for a majority of the pre-commitment

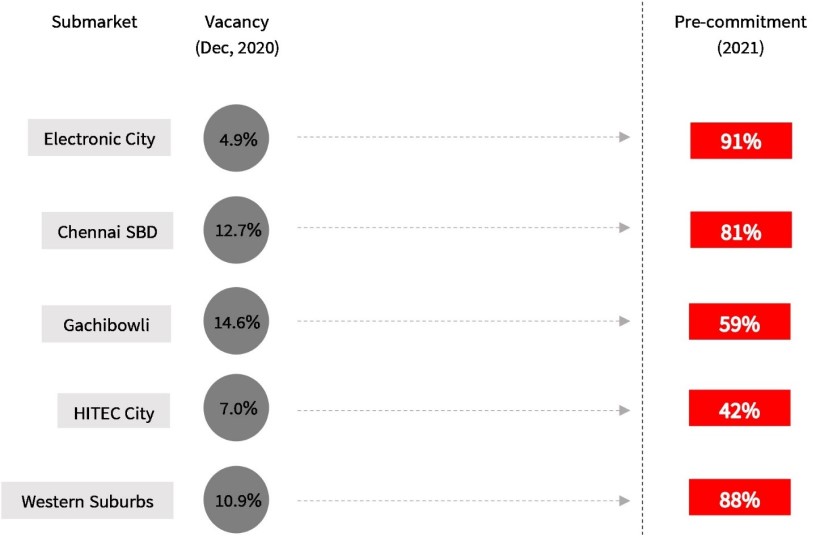

Further analysis suggests that the activity is concentrated in the office submarkets with low vacancies. Submarkets like Electronic City in Bengaluru; SBD (Mount Poonamallee Road) in Chennai; HITEC City and Gachibowli in Hyderabad; and Western Suburbs in Mumbai, witnessed the maximum pre-commitment activity (Figure 2).

It is pertinent to note that pre-commitment deals are mostly witnessed in projects by reputed developers with a proven track record of timely delivery. Moreover, well-planned amenities and contiguous large floor plates are important factors that entice occupiers to commit to office spaces in the under-construction phase.

Figure 2: Majority pre-commitment in low vacancy submarkets

IT-ITeS occupiers drive pre-commitment activity

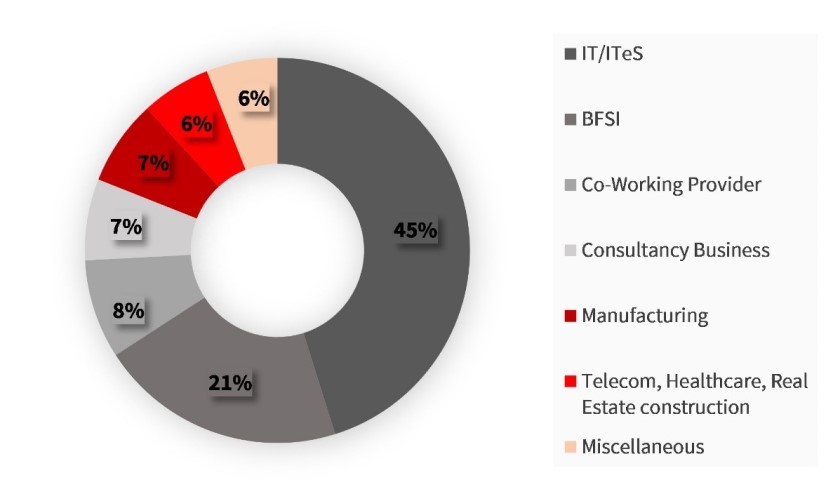

The pre-commitment activity is being driven by IT-ITeS occupiers across the seven major office markets in India (Figure 3), except for Mumbai. These occupiers require larger floor plates, and pre-commitment becomes a necessity in markets with limited availability of Grade A office spaces. In Mumbai, BFSI occupiers account for 69% of the pre-committed space in 2021.

Figure 3: IT-ITeS occupiers constitute 45% of the pre-committed space

Demand for office spaces unlikely to reduce in the near future

The year 2020 saw office occupiers adapting to the rapidly changing environment by being agile and focusing on employee wellness. While flexible working practices will continue, the demand for office spaces is unlikely to reduce in the times to come. The strong pre-commitment activity is testimony to the sustained importance of office real estate in corporate occupiers’ business plan. Large companies find it viable to pre-commit spaces for future requirements. It gives them an opportunity to negotiate flexible lease terms and cover future risk against market rental escalations. Pre-commitment is a barometer of a market’s business activity and the strong pre-commitment activity being witnessed portends well for the future of the office market in India.